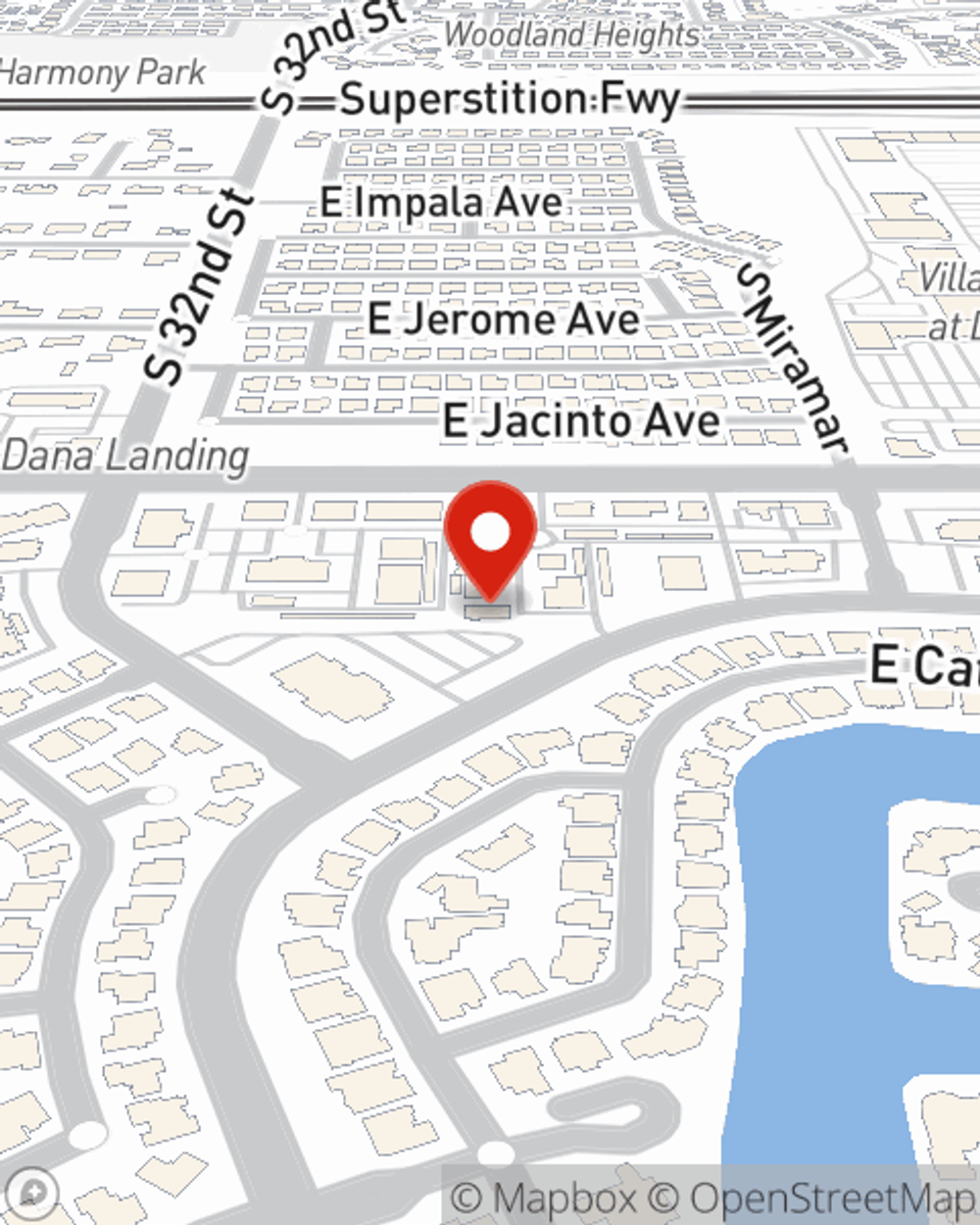

Business Insurance in and around GILBERT

GILBERT! Look no further for small business insurance.

Cover all the bases for your small business

State Farm Understands Small Businesses.

Preparation is key for when something unavoidable happens on your business's property like a staff member getting hurt.

GILBERT! Look no further for small business insurance.

Cover all the bases for your small business

Strictly Business With State Farm

The unexpected is, well, unexpected, but that doesn't mean you shouldn't be prepared. State Farm has a wide range of coverages, like errors and omissions liability or worker's compensation for your employees, that can be created to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Tom Duffy can also help you file your claim.

Don’t let concerns about your business keep you up at night! Call or email State Farm agent Tom Duffy today, and explore how you can benefit from State Farm small business insurance.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Tom Duffy

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.